Chinese monetary establishments lent $1.34 trillion to growing nations from 2000 to 2021, U.S. researchers in a file that confirmed the world’s largest bilateral lender switching from infrastructure to rescue lending.

While lending commitments peaked at nearly $136 billion in 2016, China nonetheless dedicated to nearly $80 billion of loans and provides in 2021 in accordance to the data, which captures nearly 21,000 tasks in a hundred sixty five low and center profits nations as probable the most complete dataset of its type.

Overseas finance has gained Beijing allies throughout the creating world, whilst drawing criticism from the West and in some recipient countries, consisting of Sri Lanka and Zambia, that infrastructure tasks it funded saddled them with debt they have been unable to repay.

Both the sources and the center of attention of China’s remote places financing, have changed, the information showed.

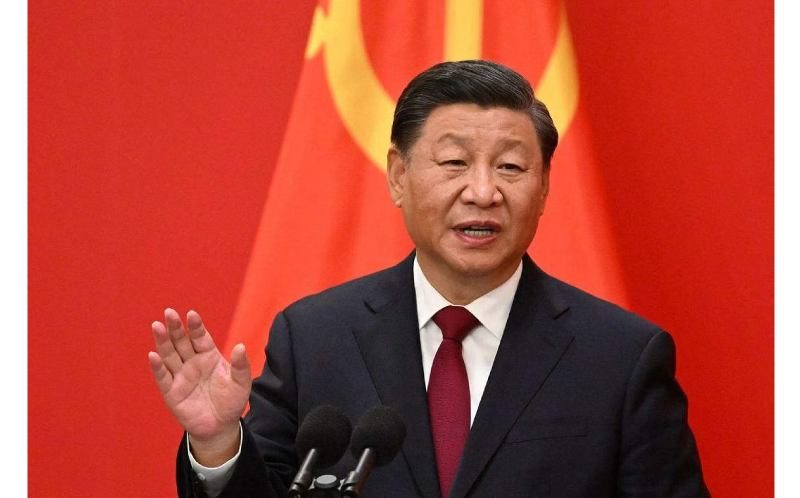

In 2013, when President Xi Jinping launched the Belt and Road Initiative to construct infrastructure throughout the creating world, China’s coverage banks accounted for over half of of the lending. Their share commenced falling from 2015 and used to be 22% by means of 2021.

The People’s Bank of China and the State Administration of Foreign Exchange (SAFE), which manages China’s overseas foreign money reserves, accounted for extra than 1/2 of lending in 2021, nearly all bailout lending. “Beijing is navigating an unfamiliar and uncomfortable role— as the world’s biggest reliable debt collector,” stated the record, a lookup lab at William and Mary university.

Much of China’s developing rescue lending is denominated in renminbi, the record found, with loans in the Chinese forex overtaking U.S. bucks in 2020. Overdue repayments to Chinese lenders have additionally risen. One way China is managing reimbursement hazard is via overseas foreign money money escrow bills it controls. The association is controversial due to the fact it offers China debt seniority, which means different lenders, which includes multilateral improvement banks, should get paid 2nd at some point of any coordinated debt relief.

AidData recognized 15 countries, specially in Africa, with escrow money owed totalling a mixed $2.5 billion at their top in June 2023.

Brad Parks, the study’s lead author, stated they have been now not capable to become aware of all such accounts, as they are typically saved private. He noted, though, that they had observed collateralised loans well worth $614 billion and that money was once the most important supply of collateral required by using Chinese lenders, indicating that the quantity in escrow money owed may want to be some distance greater than $2.5 billion.

China is additionally working extra with multilateral lenders and Western business banks. Half of its non-emergency lending in 2021 used to be syndicated loans, 80% of that alongside Western banks and global economic institutions.

The locations of Chinese foreign places lending have additionally changed. Loan commitments to African international locations fell from 31% of the whole in 2018 to 12% in 2021, whilst lending to European international locations nearly quadrupled to 23%.

A specific dataset confirmed mortgage commitments to African international locations falling to a 20-year low in 2022.

Business4 weeks ago

Business4 weeks ago

Health3 weeks ago

Health3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Sports3 weeks ago

Sports3 weeks ago

Science3 weeks ago

Science3 weeks ago

Business2 weeks ago

Business2 weeks ago

Science2 weeks ago

Science2 weeks ago

Science1 week ago

Science1 week ago