Business

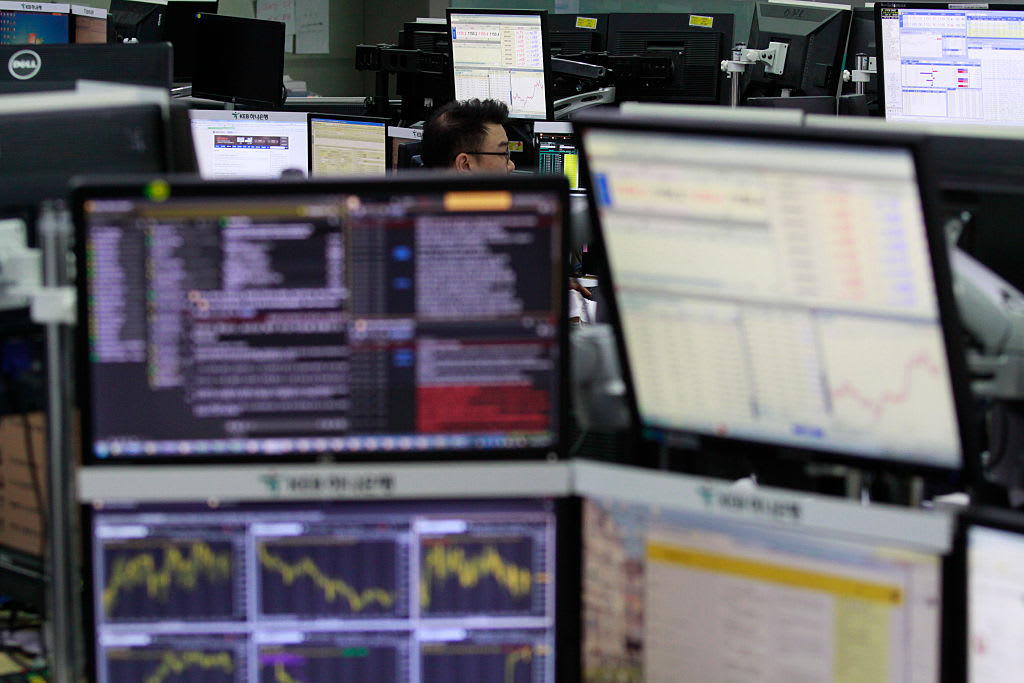

Asia-Pacific business sectors lower as IMF minimize growth estimate for the region

-

Business4 weeks ago

Business4 weeks agoAustal, a startup, has Raised $43 Million to Build a Massive sailing cargo trimaran

-

Health3 weeks ago

Health3 weeks agoSamsung’s Android Health App Has Been Updated

-

Technology3 weeks ago

Technology3 weeks agoApple has revealed a revamped Mac Mini with an M4 chip

-

Sports3 weeks ago

Sports3 weeks agoDodgers Unveil Plans for Friday Parade and Stadium Celebration

-

Science3 weeks ago

Science3 weeks agoAstronauts Confront Vision Challenges in Space with Upcoming Dragon Mission

-

Business2 weeks ago

Business2 weeks agoMining waste is converted by a startup into vital metals for the US

-

Science2 weeks ago

Science2 weeks agoSpaceX will launch 24 Starlink satellites from Florida on Monday

-

Science1 week ago

Science1 week agoExosonic, a Startup, Experiences a Supersonic Explosion Before Failing