This Labor Day will be the keep going for Stein Mart, Pier 1 Imports and different stores holding leaving business liquidation deals.

Different retailers likewise are holding deals for the occasion end of the week. Work Day is a government occasion committed to the accomplishments of American specialists and held yearly on the main Monday of September.

In contrast to Christmas, Easter and Thanksgiving, most significant retailers are regularly open Labor Day with one super-sized exemption. All Costco Wholesale clubs are shut Monday like they are for New Year’s Day, Easter, Independence Day, Memorial Day, Thanksgiving and Christmas.

In any case, in the midst of the Covid pandemic, what organizations will be open Monday – and their hours – can change contingent upon where you live. A few will have unique occasion hours and numerous drug stores will be shut.

As per information from Womply, a private venture programming supplier, 15% of stores are as yet shut.

“Retailers have been hit hard by the pandemic and are eager to stimulate sales,” said Brad Plothow, vice president of corporate marketing and communications for Womply. “Be sure to check with your favorite shop to see if they’re offering promotions, delivery, or curbside pickup.”

Minnesota-based Red Wing Shoe Company is changing more than 525 of its stores into center points for individuals to look for neighborhood exchange occupations Monday and is exchanging its client assistance line, 800-RED-WING, “into a job search hotline to offer both free guidance as well to help connect the unemployed to more open positions.”

Michigan-based workwear brand Carhartt likewise is shutting its retail locations and U.S. fabricating offices for the third year straight.

Secret seeds no more?:Amazon boycotts unfamiliar seeds, plants deals as examination over strange bundles proceeds

Help for little businesses:Lowe’s giving out Covid private company alleviation allows up to $20,000 through not-for-profit LISC. Cutoff time to apply is Monday

Store bringing deals to a close proceed

Since May, Ascena Retail Group, parent organization of Justice, Ann Taylor and Lane Bryant, New York and Company’s parent organization RTW Retailwinds, Lucky Brand, J.C. Penney, Brooks Brothers, Sur La Table, Neiman Marcus, Tuesday Morning, Tailored Brands, GNC, Lord + Taylor and J. Group have all petitioned for Chapter 11.

Different retailers, who haven’t petitioned for financial protection, additionally plan to shade areas, including Victoria’s Secret, Nordstrom and Signet Jewelers, parent organization of Kay, Zales and Jared.

As of Sunday, there were just 118 residual Justice stores recorded on the retailer’s site. Before Ascena petitioned for financial protection in July, the tween brand had 826 strength retail and outlet stores designed for young ladies 6 to 12.

The greater part of the stores that have sought financial protection are done taking store gift vouchers or tolerating returns.

Time is heading out to utilize gift vouchers for off-value retailer Stein Mart. The most recent day to utilize gift vouchers and product credits is Sept. 21 and prize testaments lapse on Sept. 12.

Work Day grill food safety:Grilling counsel to assist you with remaining safe this occasion end of the week

Wendy’s Labor Day weekend deal:Wendy’s brings back pretzel buns for new Pretzel Bacon Pub Cheeseburger with brew cheddar

Stores open Labor Day 2020

Most stores are as yet working with decreased hours due to COVID-19 and others will diminish hours. Most drug stores are shut. Look at with your store before heading. Snap on store names to look for area explicit data.

- Academy Sports + Outdoors

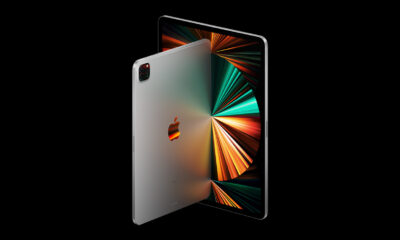

- Apple

- Bass Pro Shops

- Bealls Florida

- Bealls Outlet

- Bed Bath and Beyond

- Belk

- Best Buy

- Big 5 Sporting Goods

- Big Lots

- BJ’s Wholesale Club

- Burlington

- buybuy Baby

- Cabela’s

- Conn’s HomePlus

- Container Store

- CVS

- Dick’s Sporting Goods

- Dillard’s

- Dollar General

- Dollar Tree

- DSW

- Ethan Allen

- Family Dollar

- Five Below

- GameStop

- Guitar Center

- Home Depot

- J.C. Penney

- Joann Stores

- Kirkland’s

- Kmart

- Kohl’s

- Leslie’s Pool Supplies

- Lowe’s

- Macy’s

- Marshalls

- Menards

- Michaels

- Neiman Marcus

- Nordstrom

- Nordstrom Rack

- Office Depot and OfficeMax

- Old Navy

- Gathering City

- Petco

- PetSmart

- Pier 1 Imports

- Rack Room Shoes

- Rite Aid

- Ross

- Saks Fifth Avenue

- Sam’s Club

- Burns

- Shoe Carnival

- Stein Mart

- Target

- T.J. Maxx

- Tuesday Morning

- Ulta Beauty

- Walgreens

- Walmart

Grocery stores, convenience stores open Labor Day

Most markets are as yet working under decreased hours due to COVID-19. Some may likewise have shorter hours Monday. Extra stores, service stations and comfort stores additionally are required to be open. Look at before heading.

- 7-Eleven

- Acme

- Albertsons

- Aldi

- Baker’s

- BI-LO

- Bravo Supermarkets

- Circle K

- City Market

- Copps

- Cub Foods

- Cumberland Farms

- Dillons

- Food Lion

- Fred Meyer

- Fresh Market

- New Thyme

- Fry’s Food Stores

- Giant

- Giant Eagle

- Harris Teeter

- Harveys Supermarket

- H-E-B

- Hy-Vee

- Ingles

- King Soopers

- Kroger

- Love’s Travel Stops

- Lucky Supermarkets

- Meijer

- Pilot Flying J

- Publix

- Ralphs

- Safeway

- Save-A-Lot

- Sheetz

- ShopRite

- Fledglings

- Stop and Shop

- Trader Joe’s

- TravelCenters of America

- Vons

- Wawa

- Weis Markets

- Wegmans

- Whole Foods Market

- Winn-Dixie

Labor Day stores closed 2020

Entertainment4 weeks ago

Entertainment4 weeks ago

Entertainment3 weeks ago

Entertainment3 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Entertainment2 weeks ago

Uncategorized3 weeks ago

Uncategorized3 weeks ago

80%+ job placement rate for DigiRoads Classes students.

80%+ job placement rate for DigiRoads Classes students. Live Digital Marketing Projects – Gain direct experience running SEO, PPC, and social media campaigns.

Live Digital Marketing Projects – Gain direct experience running SEO, PPC, and social media campaigns.