In this unique and first of its kind situation after the Spanish

flu in 1918, it is a huge wakeup call of nature with around 2 Lakh factories in

India being shutdown with at least 5 billion-man days lost until now.

As India along with the rest of the world looks to determine

ways to tackle this pandemic some key elements that will determine the way forward

will be people, market demand, supply, and cash (liquidity).

As India moves toward the

true essence of swadeshi, the shift & focus will be surely on “Make in India”

which will see an influx of capital as companies shift base from China.

For Indian manufacturers who have so far been heavily dependent

on China like the rest of world, self-reliance and localisation will be the new

mantra for sustainability.

With restricted movement

of people, labour, goods, transport in India and across the world, technology

too shall have its own limitations and any setup without an alternate supply

will face a massive glitch due to hindrance in the supply chain, although government initiatives like the 20L crores

package for revival of the economy will help drive localisation.

It would be pertinent to look at one of the lesser known but an

extremely important and interesting technology driven sectors in our country,

the P/M (Powder Metallurgy) sector.

Powder

Metallurgy ( in short P/M )is an art in the science of

making metallic components from the corresponding constituent metal powders.

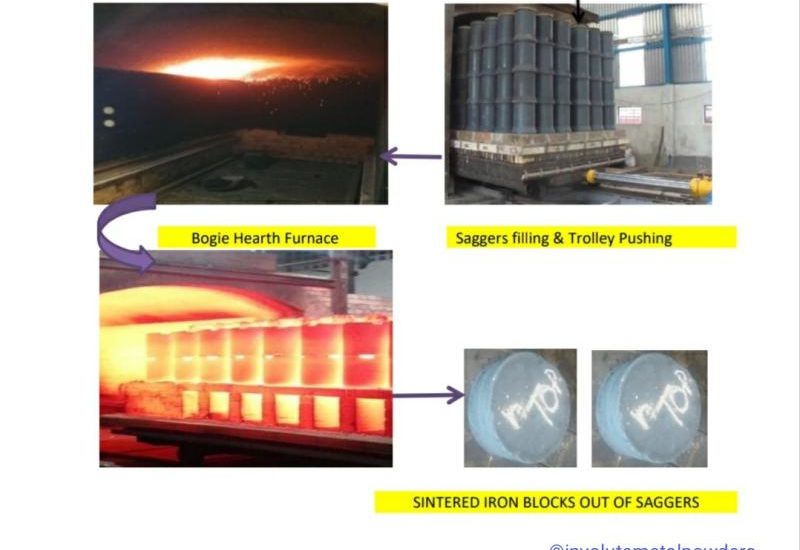

These metal powders produced are

compacted and sintered (diffusion bonded) to make the required machine

components called sintered parts.

Powder Metallurgy is

divided into two broad parts, one; manufacturing metal powders of ferrous and

non-ferrous metals and their alloys and the other; using powders to make the

parts.

80% of metal powders used in the P/M industry are Iron based

Powders while 20 % are nonferrous.

Almost a million tons of iron powder is used

worldwide each year. Around 90% of this quantity is used in the production of

sintered components & 75% – 80% of sintered components are used in the

automotive industry. The rest can be found in appliances, business machines,

bicycles, hand tools and other implements made in large numbers.

The history of sponge iron powders in INDIA goes to back to 350

A.D evidence of which can be seen in IRON PILLAR at Delhi.

However, it was in 1911, that Hoganas A.B. of Sweden, re-invented

the process of making sponge iron by a chemical reduction process, using

Magnetite Iron Ore as a melting feed stock. In 1931, the process evolved

towards the manufacture of sponge iron powder by employing double stage

reduction.

While HOGANAS SWEDEN holds the world’s largest market share of

sponge iron powder, the rest of the global players as QUEBEC & KOBE make

ATOMISED & REDUCED grades, Chinese companies sell a mix of these in India,

but their quality remains inconsistent.

India solely depends on imports of Iron Powders that are used

extensively for components required for the automotive sector, along with

welding, cutting and structural parts. Due to this unprecedented situation, it

has become extremely necessary to be independent and start the manufacturing in

India.

Here we would like to reinstate that these Iron Powders or any

other non-ferrous can be produced in India without any technological import or

assistance.

One day in the year 1982, the legendary late Dr. Henry

H.Hausner, the International Authority and Father of Powder Metallurgy ,told our mentor Mr. S.

Mohanty, “The basics of Powder Metallurgy, is a game of sizes and shapes

of powder particles and is an ART of its class”.

For Mr.S. Mohanty the researcher and inventor in this technology ,it has been a long journey of more than four

decades of persistent efforts of pioneering applied research that led to the

development of this technology . It continues even to this day with many

proprietary works some of which that are patented vide Indian Patents nos.

154181, 168601, 171892 & 18635.

Our company Involute Metal Powders (IMPT) formerly S Mohanty

& Co. been instrumental in setting up many metal powder industries in India

for the manufacture of Copper, Bronze, Tin , Diluted Bronze and other alloy

powders.

‘Ironically though, even after being the only technology

provider in the world for the manufacture of sponge iron powder by the reduction process

other than Hoganas, India still lags

behind significantly in setting up a manufacturing facility which can stand at

par with world standards and break the monopoly of the Iron Powder giant of the

world.’

An indigenous process for manufacture of Sponge Iron powder has

been developed by the erstwhile S.Mohanty & Co registered under patent

no. 154181. The process involves two stage reduction of Iron Mill Scales,

instead of Magnetite. This process remains unique as no other REDUCTION process

has been developed so far nor could a prototype of the Hoeganaes process be

implemented anywhere in the world. In yet another first, Involute Metal Powders

has developed a high compressibility Iron Powder by the same two stage

reduction of Mill Scales (vide Patent no.171292) .

Some APPLICATIONS OF

IRON POWDER

- Self-lubricating

bearings

- Parts with complicated

geometry where high green strength is essential.

- Shock absorber parts

- High density P/M

structural parts

- Clutches and pulleys

- Brake pads and brake

shoes

- Soft magnet

applications

- Welding electrodes

- Metal Cutting &

Scarfing

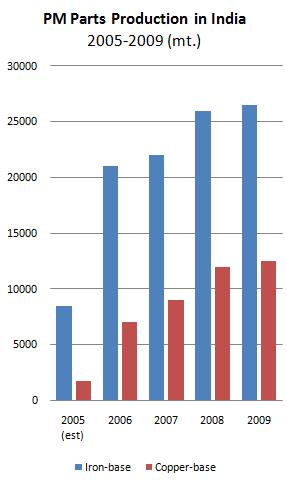

The Indian Automotive industry is the world’s fourth largest and

expected to reach around 18 trillion rupees (US$ 251.4-282.8 billion) by

2026.

While the Two-wheeler industry consumes approx. 90,000 tons

of metal powder per year, the

Four-wheeler industry consumes around 75,000 tons per annum.

Thus even though the total consumption of sponge iron powder in

INDIA is approx 132000 tonnes/year, we are yet to meet the demand of the

market.

The drawback of not having indigenous factories to produce metal

powders and the resultant dependence on imports makes for an expensive

proposition and depletes market competitiveness.

Foreseeing a future where World economic and technological

situations will alter post COVID, setting up captive plants for in -house

consumption and huge standalone manufacturing facilities would help cater to the

demands of Indian and Asian Markets that are growing rapidly.

With emphasis on MAKE IN INDIA initiative & ATMANIRBHAR BHARAT

by our honourable Prime Minister, the Indian government will incentivise the

industry and its end users to go for indigenous products, processes, and

innovative projects.

An initiative by a local giant or a start-up to go for an indigenous process to manufacture Iron Powder would go a long way in taking India towards being a game changer for the Powder Metallurgy industry and a market leader in the field.

Soumya Vilekar, entrepreneur, a joint patent holder in metal powders,

CEO, INVOLUTE METAL POWDER TECHNOLOGIES LLP

www.powdertechnologies.com

Business4 weeks ago

Business4 weeks ago

Business4 weeks ago

Business4 weeks ago

World4 weeks ago

World4 weeks ago

Technology4 weeks ago

Technology4 weeks ago

Business4 weeks ago

Business4 weeks ago

Business3 weeks ago

Business3 weeks ago

Entertainment3 weeks ago

Entertainment3 weeks ago

Science3 weeks ago

Science3 weeks ago

80%+ job placement rate for DigiRoads Classes students.

80%+ job placement rate for DigiRoads Classes students. Live Digital Marketing Projects – Gain direct experience running SEO, PPC, and social media campaigns.

Live Digital Marketing Projects – Gain direct experience running SEO, PPC, and social media campaigns.